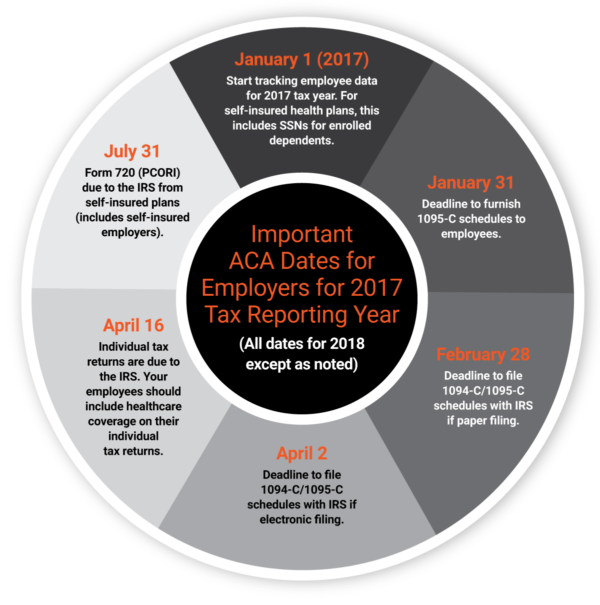

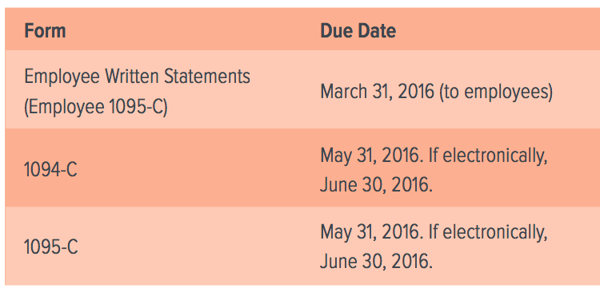

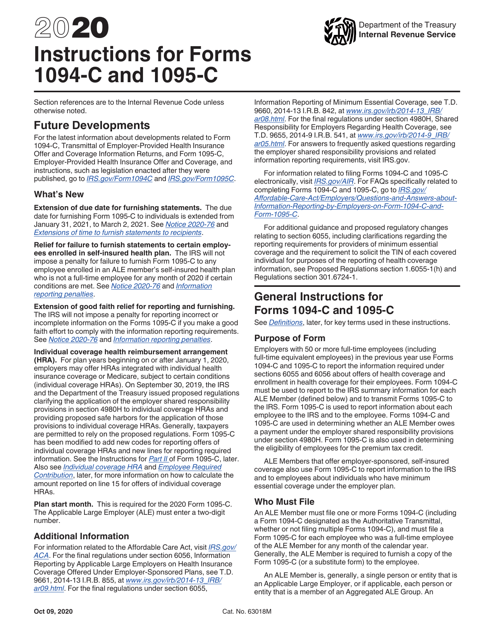

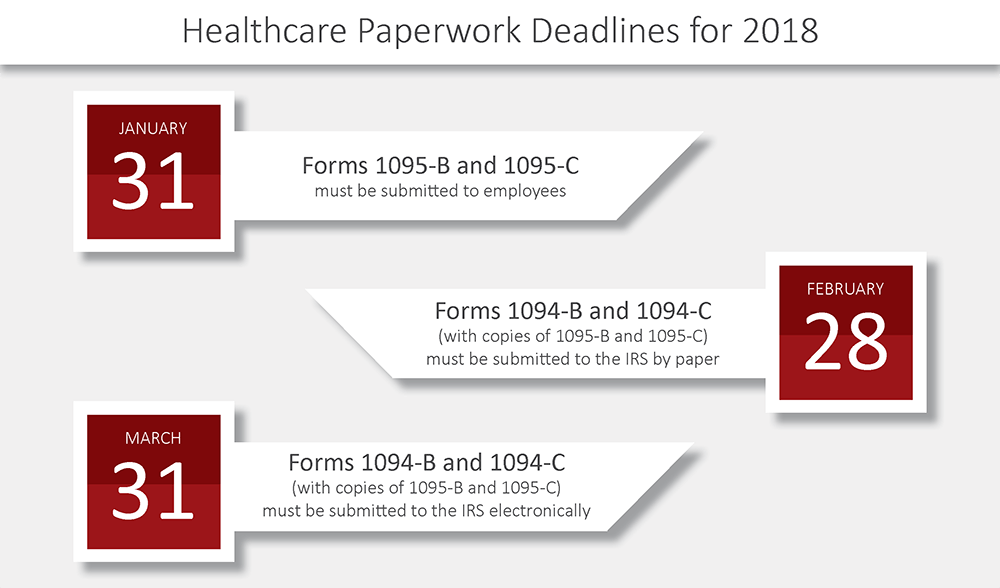

By Melissa Ostrower and Jackson Lewis PC on Posted in 1094C, 1095C, Affordable Care Act In IRS Notice 1806, the IRS announced a 30day automatic extension for the furnishing of 17 IRS Forms 1095B (Health Coverage) and 1095C (EmployerProvided Health Insurance Offer and Coverage), from to Given it is already , an employer will need to check the "electronic" box in order to file the Form 09 in a timely fashion The only other pertinent box for filing an extension for the Forms 1094C and 1095C is part 6 The employer should check the "1094C, 1095C" box in the far right columnA business day is any day that is not a Saturday, Sunday, or legal holidayGenerally, you must file Forms 1094C and 1095C by February 28 if filing on paper (or March 31 if filing electronically) of the year following the calendar year to which the return relates

2

1094 c 2018 instructions

1094 c 2018 instructions- The IRS just announced a 30day extension to the deadline for providing 18 Forms 1095C and 1095B to individuals The deadline is now , instead of The IRS did NOT extend the deadlines for filing 18 Forms 1094C and 1094B with the IRS (see below for these dates)The deadline to March 2nd, 18 The IRS 1094 transmittal submission deadline remains March 31st, 18 The IRS also extended some aspects of transition relief for "good faith effort", however penalties will apply for failure to file or make a good faith effort to follow the regulations (see IRS Notice 1670) The penalty for

Is Your Organization Ready To File The 1094 C Form Mici Com

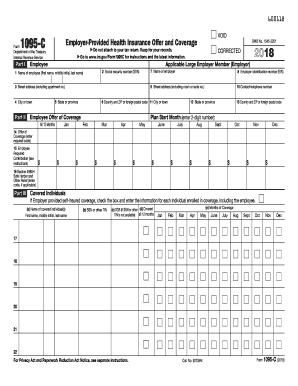

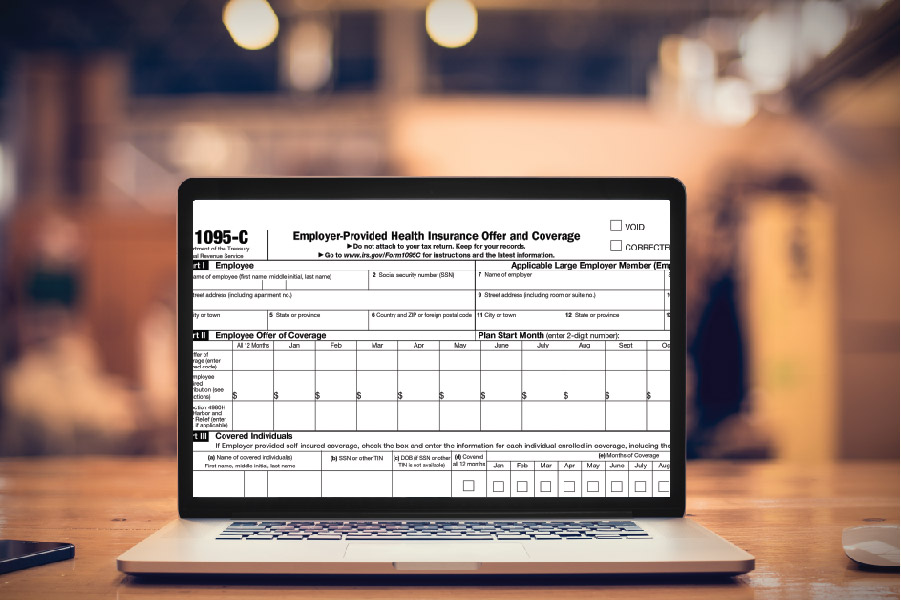

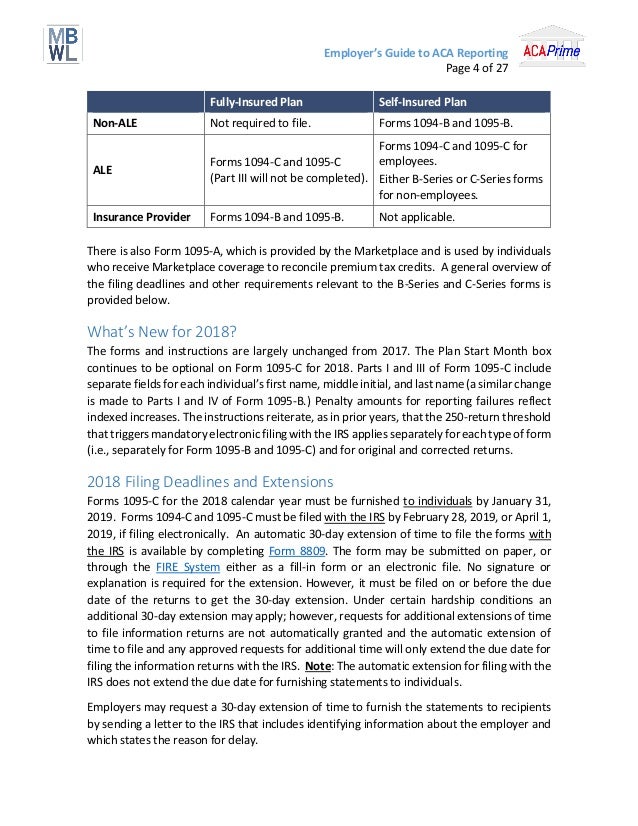

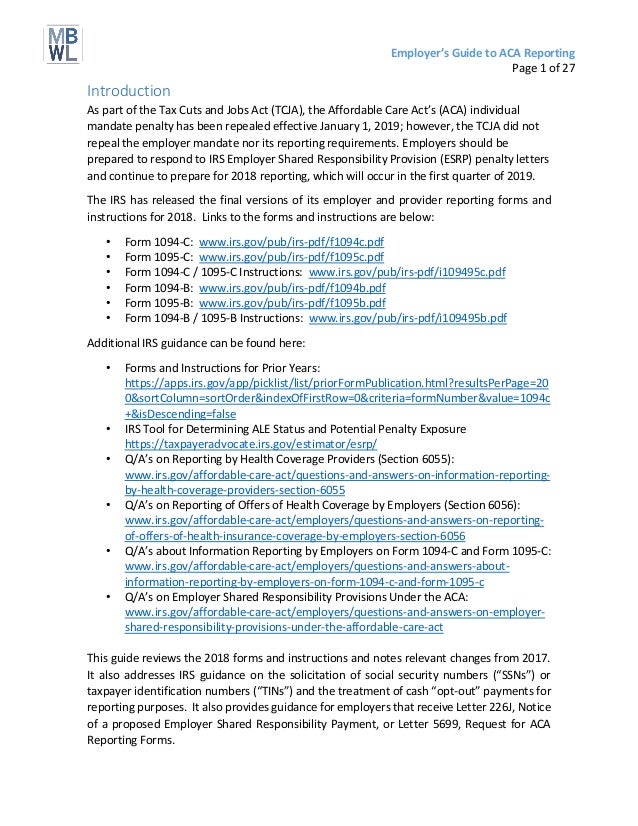

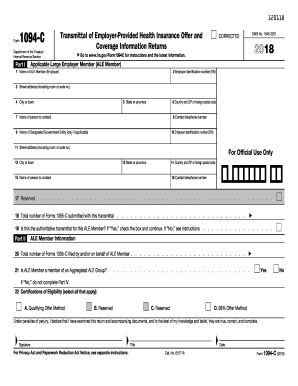

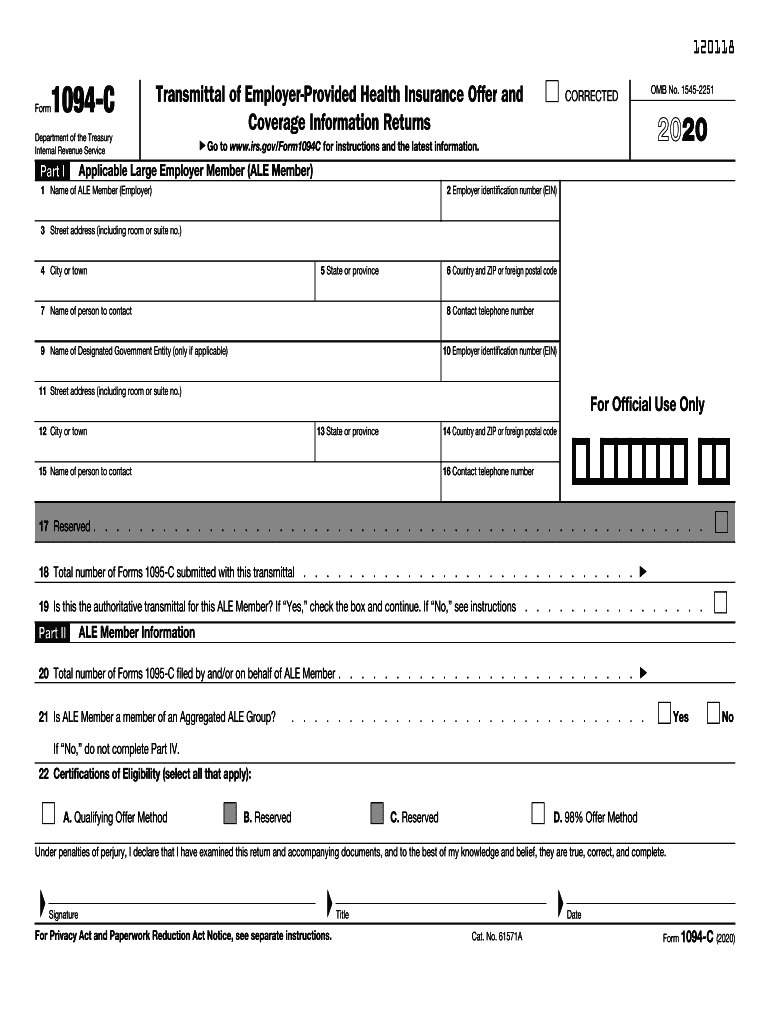

Form 1094C and Form 1095C are IRS forms that employers must file if they are required to offer their employees health insurance under the Affordable Care Act (ACA) The primary difference between these two forms is that Form 1095C includes health insurance information and is provided to the IRS and employees The IRS doesn't like to create entirely new forms if it needs to make changes, so it reserves a line just in case Line 18 Because the 1094C is like a cover sheet for the 1095C, you calculate how many total 1095Cs you are submitting with The IRS has released the final 1094/1095C schedules and reporting instructions for the 18 tax year, to be filed and furnished in 19 You can find the 18 instructions at this link The new 18 version of Form 1094C and Form 1095C are available at these links 18 Form 1094C 18 Form 1095C The IRS has also issued the filing schedule for ACA reporting for the 18

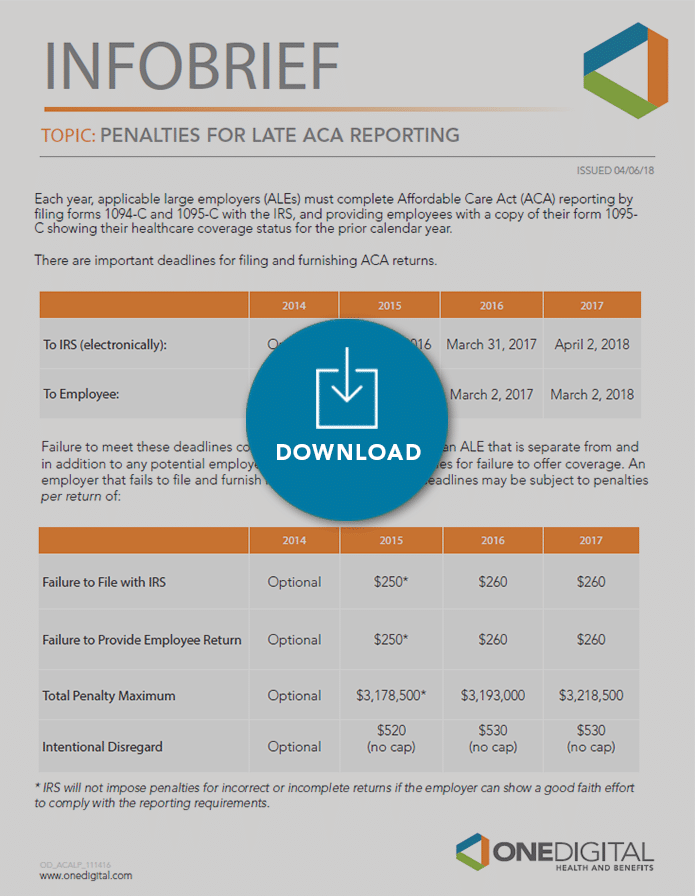

The IRS issued Notice 1806 on Dec 22, 17, which extended by 30 days the 18 due date for distributing 17 health coverage information forms 1095C or 1095B to employees, regarding the19 ACA 1094/1095 Deadlines Chart Due Dates in 19 Action Fully Insured ALEs SelfInsured ALEs SelfInsured Employers That are not ALEs (Fewer Than 50 FullTime Employees) Provide Form 1095C to FullTime Employees January 31 January 31 Not Applicable Provide Form 1095B to Responsible Individuals (may be the primary insured, employee, You can learn more about the specifics for filing 1094B and 1095B here and 1094C and 1095C here And if you have any other questions, Health e(fx) can help, Contact us today Share this Click to share on Twitter (Opens in new window)

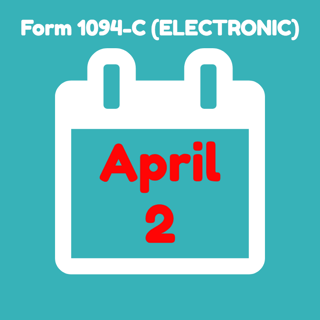

October 18 The Internal Revenue Service ("IRS") has released the final 18 version of the Affordable are Act ("AA") Information Reporting forms, aka Forms 1094 and 1095 and instructions Applicable Large Employers ("ALEs")¹ are obligated to issue and file the 18 AA information returns Other than some formattingFor 18, the deadlines are • — Send Form 1095 copies to recipients/employees • — Paper filing of 1095s (and 1094 transmittals) to IRS • — Efiling of 1095s (and 1094 transmittals) to IRS Employers missing the filing deadlines with the IRS for forms 1094C and 1095C or who file This is the deadline for filing the Form 1094C transmittal (and copies of related Forms 1095C) with the IRS, if you are filing electronically Electronic filing is mandatory if you are required to file 250 or more Forms 1095C for the 17 calendar year;

Vehi Org Client Media Files Ale Webinar Presentation Part Ii Examples10 3 18 Pdf

1095 18 Fill Out And Sign Printable Pdf Template Signnow

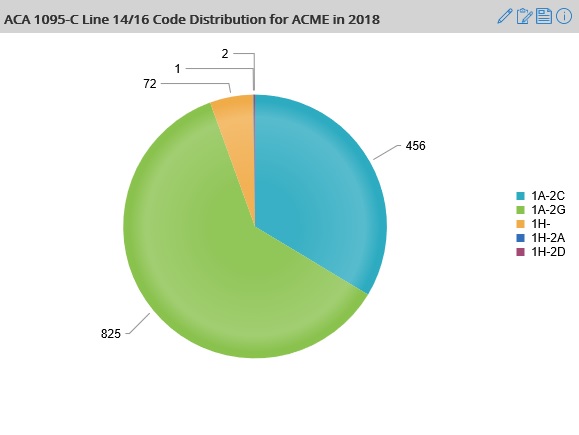

A MAACA, C Vice President Director of HR Tech & Outsourcing Locton Benet roup bmandacina@locktoncom Many employers working to accomplish Affordable Care Act (ACA) reporting are puzzled by Line 22 on Form 1094C That line asks the employer whether it has used the "Qualifying Offer Method" or the "98% Offer Method"Generally, you must file Forms 1094C and 1095C by February 28 if filing on paper (or March 31 if filing electronically) of the year following the calendar year to which the return relates For calendar year 18, Forms 1094C and 1095C are required to be filed by , or , if filing electronically For the 18 tax year, the IRS plans to send 226J letters until June of 21 The 226J notice indicates the initial assessment of 4980H liability, which is based directly on what was filed on 1094C/1095C If there were errors in filing, this information must be corrected by researching years past to determine what should have been filed

Amazon Com 18 Complyright 1095 B Health Coverage Forms And Envelopes With Aca Software Pack Of 50 Forms Ab1095e50samz Office Products

Irs Releases Draft Forms And Instructions For 18 Aca Reporting Brinson Benefits

No A Form 1094C (18) DO NOT FILE DRAFT AS OF 1218 Form 1094C (18) Page 2 Part III ALE Member Information—Monthly (a) Minimum Essential Coverage Offer Indicator Yes No (b) Section 4980H FullTime Employee Count for ALE Member (c) Total Employee Count for ALE Member (d) AggregatedUpdated For Administrators and Employees Here's how to determine which IRS address to use when filing ACA forms by mail For more information about IRS mailing addresses, see the IRS Instructions for Forms 1094C and 1095C page The IRS extended the Jan 31, 19, deadline for employers to distribute 18 Forms 1095C or 1095B to employees until Many employers may still prefer to distribute the 1095 forms

Www Irs Gov Pub Irs Prior F1094c 18 Pdf

Www Tasconline Com Uploads Aca reporting Tc 6051 18 aca quick start guide Pdf

Just started a new job as an HR Generalist and we've discovered that our Employer failed to file 1094C and 1095C with the IRS We are a selfinsured ALE The entire department retired this summer, we don't know what the IRS has been told I heard we got a letter that our extension was denied, b The Internal Revenue Service (IRS) recently released the 1094C / 1095C forms and instructions to be used by Applicable Large Employers (ALEs) for the 18 tax year reporting required by the Affordable Care Act (ACA) ALEs sponsoring a selffunded health plan may use Part III of Form 1095C to provide individual coverage information to plan participants in lieu of providing Form 1094Otherwise, electronic filing is encouraged, but not required

Blog Irs 1094

Irs Roundup What You Need To Know About The Irs And The Affordable Care Act The Aca Times

The IRS has released draft Forms 1094/1095B (B Forms) and Forms 1094/1095C (C Forms), and related instructions, for the 18 tax year As a reminder, the B Forms are filed by minimum essential coverage providers (mostly insurers and governmentsponsored programs, but also some selfinsuring employers and others) to report coverage information in accordance with It is important to note the IRS has not extended the due date for filing 18 Forms 1094B, 1095B, 1094C, or 1095C with the IRS The deadline remains , for those with 250 or fewer forms filing by paper, or , if filing electronically The IRS also extended its transition relief with respect to penalties if good The IRS recently released the final instructions to the Forms 1094C and 1095C with minimal changes compared to the final instructions from 17

What Are The Form 1094 C And 1095 C Requirements For Fully Insured Health Plans In

2

18 Form 1094C 18 Form 1094C 17 Form 1094C 17 Form 1094C 16 Form 1094C 16 Form 1094C 15 Form 1094C 15 Form 1094C TaxFormFinder Disclaimer While we do our best to keep our list of Federal Income Tax Forms up to date and complete, we cannot be held liable for errors or omissions Is the form on this page outofdate orThe 18 Form 1094C and all supporting Forms 1095C (collectively, "the return") is due to the IRS by if filing electronically (or if filing by paper) These deadlines were not extended as part of the relief announced in Notice 14 Mailing Instructions for Filing Paper Forms 1094C and 1095c Updated For Administrators and Employees Here are some general tips for employers who wish to file their Forms 1094C and 1095C by mail Send the forms to the IRS in a flat mailing (not folded) Do not paperclip or staple the forms together

It S Year End Time Again Are You Gp Payroll Ready Erp Software Blog

2

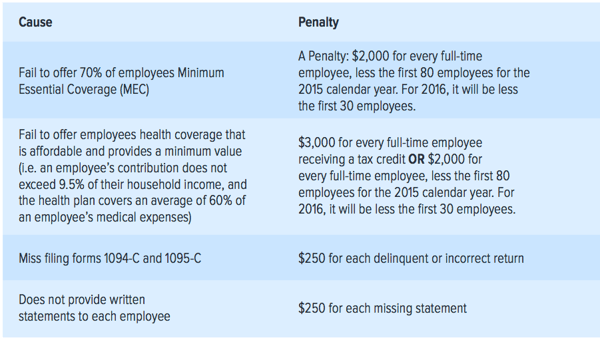

In the final days of 18, the agency started assessing penalties to organizations that failed to file forms 1094C and 1095C with the IRS or furnish 1095C forms to employees under IRC 6721/6722 for the 15 and 16 tax years This appears to be the first time the IRS has issued notices to employers that include ACA penalties under IRC 6721• Review Forms 1094C and 1095C • After your review of Letter 226J you may disagree in whole or in part with the IRS assessment Inaccurate reporting on Forms 1094C and 1095C are most likely the cause of incorrect penalty assessments The Forms 1094C and 1095C are the forms the IRS uses to calculate ESRP assessmentsForm 1094B Transmittal of Health Coverage Information Returns Inst 1094B and 1095B Instructions for Forms 1094B and 1095B Form 1094C Transmittal of EmployerProvided Health Insurance Offer

Irs Reporting Under The Affordable Care Act Bkd Llp

2

Prior Year Products Enter a term in the Find Box Select a category (column heading) in the drop down Click Find Click on the product number in each row to view/download Click on column heading to sort the list You may be able to enter information on forms before saving or printingForms 1094C and 1095C As a refresher, Forms 1094C and 1095C are used by applicable large employers to satisfy their reporting obligations To correct information on the paper version of the original Authoritative Transmittal Form 1094C, the IRS instructions provide that employers should take the following stepsNotice 14 extends this relief to 18 Forms 1094C/1095C ALEs will be eligible for relief if they can show that they made goodfaith efforts to comply with the reporting requirements for correct and complete information No relief is provided for failure to file or to furnish a statement by the due dates (as extended by Notice 14)

Aca Employer Compliance In 6 Easy Steps

How To Correct A 1094 C Non Authoritative Transmittal To An Authoritative Transmittal Youtube

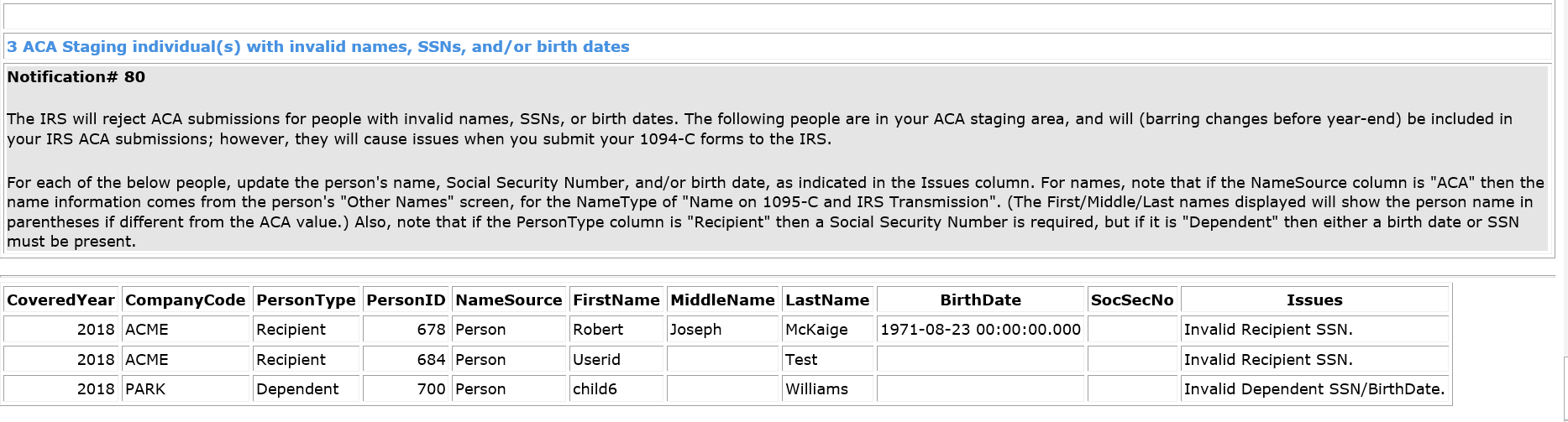

If you are filing Form 1094C, a valid EIN is required at the time it is filed If a valid EIN is not provided, Form 1094C will not be processed If you do not have an EIN, you may apply for one online Go to IRSgov/EIN You may also apply by faxing or mailing Form SS4 to the IRS See the Instructions for Form SS4 and Pub 1635 ACA Forms 1095C and related forms were due to the IRS by , if filed electronically Small employers must file Forms 1095C and 1094C if18 Instructions for Forms 1094C and 1095C Department of the Treasury Internal Revenue Service Section references are to the Internal Revenue Code unless otherwise noted Future Developments For the latest information about developments related to Form 1094C, Transmittal of EmployerProvided Health Insurance

Ez1095 Software How To File Previous 1095 C And 1094 C Aca Forms

Use This One Simple Tip To Avoid Irs Aca Penalties

About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy & Safety How works Test new features Press Copyright Contact us Creators Included on Form 1095C is information regarding Employers that fail to submit ACA Forms 1094C and 1095C annually could be subject to penalties under IRC 6721/6722 in Letter 5005A/Form 6A These penalties are separate from those assessed by the IRS for failing to comply with the responsibilities of the ACA's Employer Mandate C Form Instructions The IRS has finalized Forms 1094/1095B (B Forms) and Forms 1094/1095C (C Forms), and related instructions, for the 18 tax year As a reminder, the B Forms are filed by minimum essential coverage providers (mostly insurers and governmentsponsored programs, but also some selfinsuring employers and others) to report coverage information in

Tax Form 1094 C Transmittal Of Employer Health 1094ct Mines Press

Irs Releases Final 18 Forms 1094 And 1095 And Related Instructions And Publications

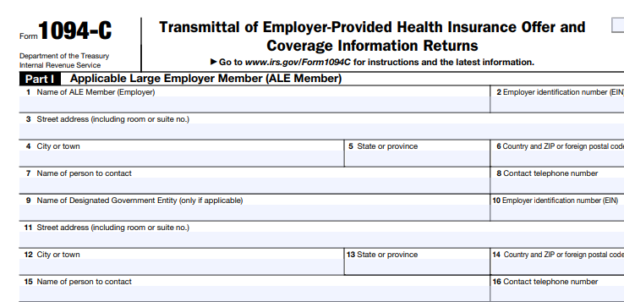

IRS Forms 1094C and 1095C are filed by employers that are required to offer health insurance coverage to their employees under the Affordable Care Act, also known as Obamacare1094C Department of the Treasury Internal Revenue Service Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns Go to wwwirsgov/Form1094C for instructions and the latest information OMB No 18 Part I Applicable Large Employer Member (ALE Member) 1 Name of ALE Member (Employer) 2Form 1094C Filing Deadline Beginning with the 18 tax year, employers must file Form 1094C to the IRS with Form 1095C Both forms are due to the IRS by February 28 th (if paper filing) or April 01 nd (if efiling) of the year following the calendar year the return references If the regular due date falls on a Saturday, Sunday, or legal

2

2

1094 C Form Fill out, securely sign, print or email your 1094 c 10 form instantly with SignNow The most secure digital platform to get legally binding, electronically signed documents in just a few seconds Available for PC, iOS and Android Start a Summary of S1094 115th Congress (1718) Department of Veterans Affairs Accountability and Whistleblower Protection Act of 171094C Department of the Treasury Internal Revenue Service Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns Go to wwwirsgov/Form1094C for instructions and the latest information OMB No Part I Applicable Large Employer Member (ALE Member) 1 Name of ALE Member (Employer) 2

Is Your Organization Ready To File The 1094 C Form Mici Com

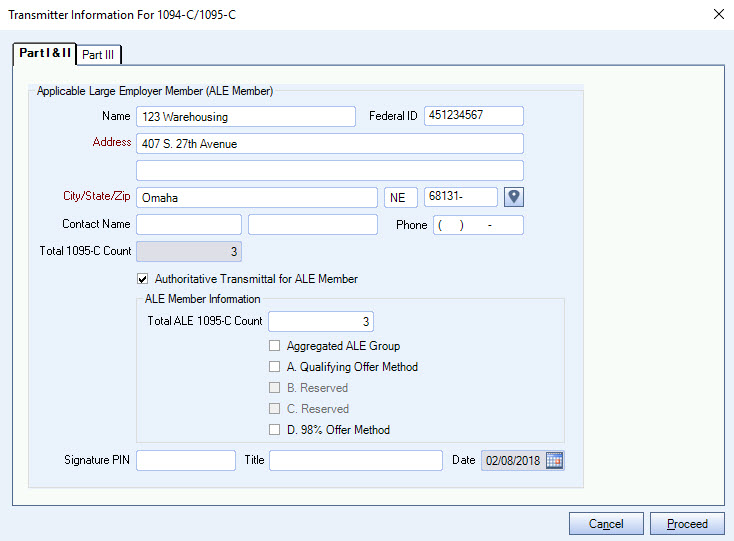

Generating An Electronic File For 1094 C

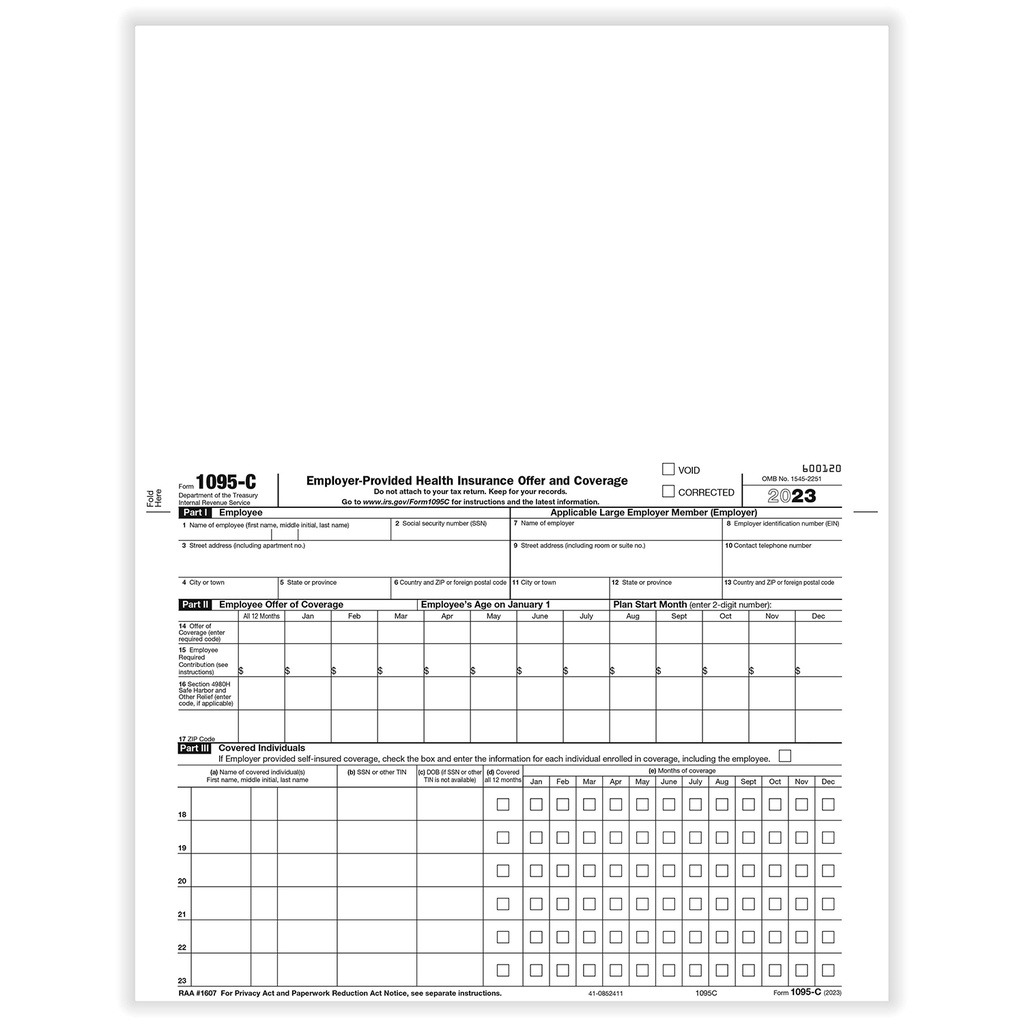

Form 1095C (18) Page 2 Instructions for Recipient You are receiving this Form 1095C because your employer is an Applicable Large Employer subject to the employer shared responsibility provision in the Affordable Care Act This Form 1095C includes

Aca Complyright 19 Aca Tax Software Use For Forms 1095 B And 1095 C And 1094 B And 1094 C Tax Forms Office Products

Amazon Com 18 Complyright 1094 C Transmittal Forms Pack Of 50 Office Products

Prepare For Aca Reporting A Step By Step Guide For Ty18 Boomtax

2

2

18 Affordable Care Act Update Bkd Llp

Updated Irs Reporting Requirements Babb Insurance

The Importance Of Year Round Aca Reporting Pds Blog

What Is The Difference Between Forms 1094 C And 1095 C Turbotax Tax Tips Videos

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

Irs Reveals Few Changes For Forms 1094 C 1095 C Blog Medcom Benefits

Compliance Reminder Electronic Submission Of Forms 1094 And 1095 B C Due April 2 18 Kistler Tiffany Benefits

Amazon Com 18 Complyright 1094 C Transmittal Forms Pack Of 50 Office Products

2

Admin Abcsignup Com Files 7b0f 03da 4619 Add5 95b8fc087aa3 7d 6 Adpproconference Acapreparenowforaseamless18filing Pdf

Compliance Alert Irs Delay In 6055 And 6056 Reporting For 18 Brinson Benefits

Irs Releases Final Forms And Instructions For 18 Aca Reporting

Affordable Care Act Employers Lawyers Blog Holland Hart Llp

Mbwl Employer S Guide To Aca Reporting 10 08 18

Aca Employer Compliance In 6 Easy Steps

1094 C Employer Health Transmittal Kit B1094cs05

2

Vehi Org Client Media Files Ale Webinar Presentation Part Ii Examples10 3 18 Pdf

Code Series 2 For Form 1095 C Line 16

Aca Reporting Deadlines For 18

2

Admin Abcsignup Com Files 7b0f 03da 4619 Add5 95b8fc087aa3 7d 6 Adpproconference Acapreparenowforaseamless18filing Pdf

2

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

Missed The 1095 C Deadlines Now What Onedigital

2

The Individual Mandate May Be Going Away Next Year But Employers Are Still On The Hook For 1094c 1095c Reporting Usi Insurance Services

Get To Know Aca Forms 1094 C And 1095 C The Aca Times

Employer Reporting Forms 1094 C And 1095 C Hays Companies

2

What You Need To Know About 1094 Forms Blog Taxbandits

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

Www Irs Gov Pub Irs Utl Instructions for ty18 predefined aats scenarios Pdf

2

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

Tax Form 1095 C Employer Provided Health Insurance 1095c Form Center

2

1

Draft Forms 1094 C And 1095 C Released Hylant

Aca Filing Services 6055 Reporting Form 1094 C

An Overview Of Forms 1095 C And 1094 C Faq American Insurance In Lewiston Amp Moscow Idaho

Ez1095 Software How To Print Form 1095 C And 1094 C

Office Depot

Mbwl Employer S Guide To Aca Reporting 10 08 18

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

Irs Issues Aca 18 Forms 1094 C And 1095 C Instructions And 226j For 16 The Aca Times

1094c Fill Out And Sign Printable Pdf Template Signnow

What You Need To Know About Forms 1094 1095

The Irs Releases Final 1094 C 1095 C Forms And Instructions For 18 Tax Year Foster Foster

2

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

Form 1094 C The Aca Times

Irs Releases Draft 18 Forms 1094 And 1095 And Related Instructions

2

Vehi Org Client Media Files Ale Webinar Presentation Part Ii Examples10 3 18 Pdf

Form Irs 1094 C Fill Online Printable Fillable Blank Pdffiller

1

Important Tax Season 18 Deadlines Are Coming Boomtax

1

2

1

2

Best Practices For Preparing Your Aca Filing Pds Blog

2

18 Affordable Care Act Update Bkd Llp

Covered California Form 1095 B Unique New Instructions For Forms 1094 C And 1095 C An Infographic Models Form Ideas

Amazon Com 18 Complyright 1094 C Transmittal Forms Pack Of 50 Office Products

Www Irs Gov Pub Irs Prior Ib 18 Pdf

Aca Open Enrollment What Employers Should Know In 18

Aca Compliance Filing Deadlines For The 18 Tax Year

2

Form Irs 1094 C Fill Online Printable Fillable Blank Pdffiller

Www Irs Gov Pub Irs Pdf P5165 Pdf

Aca Reporting Generate Review Your 1094c 1095c Data And Forms

Form 1095 A 1095 B 1095 C And Instructions

No comments:

Post a Comment